This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or Nordic) nations from the end of WW2 to today, and summarize what I’ve learned into these blog posts.

Why am I doing this? Because the ongoing debate about “Scandinavian socialism” vs “Scandinavian capitalism” interests me. I’m curious for information devoid of ideological rhetoric.

If you found this post via an Internet search, it probably makes sense to start with the first post in this series, the link to which is both above, and here.

Table of Contents

A summary of major economic changes, 1945 to the present

Pre WW2

While Norway was officially neutral during WW1, that did not prevent half of all Norweigan merchant shipping vessels from being destroyed during the war.

The allied powers were in a position to control Norway’s foreign trade, and they used that leverage to force Norway to stop exports to Germany, some of which Germany needed for their war efforts. In retaliation, Germany sank Norweigan merchant vessels.

While this loss in shipping capacity led to a recession during WW1, that recession was followed by a post-war boom in which demand outstripped supply leading to high inflation, trade deficits, currency depreciation, and an overheated economy.

When the great depression arrived in Europe in 1930, Norway shared in the downturn.

The worst year for Norway was 1931 when GDP per capita fell by 8.4% and the bottom of the business cycle for Norway occurred in 1932.

As such, the great depression was milder for Norway than most other affected nations.

Then on April 9th of 1940, Norway (and Denmark) were victims of a German surprise attack.

WW2

For the duration of WW2, Norway had two distinct economies. The domestic economy was controlled by Germany, and the foreign economy was controlled by the Allies.

This foreign economy was established on the large Norweigan merchant fleet. All the ships were united into one state-controlled company, NORTASHP.

The money this company earned was used to finance this foreign economy.

Domestically, Norway was not doing well, due to a fall in production, which fueled inflation and the need to ration supplies (including food), which three million Norwegians had to share with the 400,000 strong German occupying force.

Immediate post WW2

The Labour Party had ruled Norway since 1935 and after WW2 they immediately established a strict social democratic economy with a growing public sector and large-scale central planning.

Initially, Norway rejected the US offer of financial aid, but due to their lack of foreign currencies, they accepted Marshall plan aid.

The Marshall plan

Norway received USD $400 million from 1948 to 1952, being one of the largest per capita recipients.

International institutions

Norway quickly joined the Bretton Woods system, GATT (the precursor to the World Trade Organization) , the International Monetary Fund, and the World Bank.

Norway became a member of NATO and the UN, and in 1958 joined the European Free Trade Area (EFTA).

Boom years of 1950 to 1973

During this period, GDP per capita grew at an annual rate of 3.3 percent, foreign trade increased, unemployment dropped to near zero, and inflation was low and stable.

While this growth and stability are often considered to be the effect of the large public sector and good planning, the Noreigean growth rate during this period was lower than that of most western nations.

Oil and neoliberalism – 1973 to today

In 1969 oil was discovered on the Norwegian continental shelf. The importance of the revenue it generated can not be overstated.

Norway invests oil revenues into a Sovereign Wealth Fund, named the Government Pension Fund Global (commonly known as The Oil Fund) and that fund is now the largest sovereign wealth fund in the world.

The current fund value is USD $1.2 trillion. The government of Norway is permitted to withdraw no more than 4% of the value of the fund each year (a rule they imposed on themselves) and since the fund grows at a faster rate, the fund value keeps growing.

That less than 4% a year of the fund’s value now equals almost 20% of the annual budget of the Norweigian central government.

Norway was affected by the 1970s stagflation like most (maybe all) western nations, and responded to them in a similar fashion, by electing a conservative government in 1981 who started changing the rules of the economy to implement new neoliberal policies.

Neoliberalism didn’t go nearly as far in Norway as in some countries.

For example, Norway has no privately owned prisons and the energy company Equinor (which was formed in 2007 when Statoil and Norsk Hydro merged) is 67% owned by the Norwegian government while the rest of the shares are traded on the Oslo and New York stock exchanges (symbol EQNR).

There were however asset bubbles formed during the 1980s fueled by borrowing.

In 1990 the Norweigian krone was pegged to the ECU (which preceded the euro), but this was abandoned in 1992. The value of the krone has floated relative to other currencies ever since.

When the asset bubbles burst in 1992, the usual round of bankruptcies and the usual rise in unemployed occurred.

Norway nationalized the larger commercial banks to prevent the collapse of the financial system.

Oil continues to be an important Norweigian export to this day,

Equinor has repeatedly committed to expanding into the production of renewable energy, but it’s progressing slowly.

A possible renewable energy future?

This part is pure speculation and really has no place in a summary of what has happened, but I found a report where one of the co-authors is Mariana Mazzucato, an economist with the Economics of Innovation and Public Value at University College London.

I pay attention to her because I think she’s onto something. She devotes much of her academic research to innovation, and she has written over and over and over about how through the course of human history, what we think of as wasteful spending by incompetent governments was integral to increasing the prosperity of societies.

How you might ask? By funding the “moonshot” projects that no one else would. Specifically through “wasteful and foolish government spending”, which are my words, not hers.

The following are all projects that in their day had no discernable economic benefits, did not attract private investment, were directly funded by governments, and have turned out to have enormous economic benefits over time.

- The initial voyages of Christopher Columbus.

- The Lousiana purchase.

- The American transcontinental railroad.

- The American interstate highway system.

- The Apollo moon landings.

- The DarpaNet which led to the Internet.

None of these could provide a hard dollar return on investment in their day, but all returned enormous orders of magnitude more than they cost over time. And from an economic perspective, they all unfolded in similar ways, likely with the people involved in making the important decisions not even realizing the way history was repeating itself.

But nothing prevents us from intentionally funding targeted moonshot projects to create innovation, commercial adaptation, and future prosperity.

This idea is based on another idea, which is that growth not only has an amount, it has a direction, and that direction can be guided through laws establishing rules for the economy, and public investments in moonshot projects.

So, I think the paper she coauthored is worth a read. The title is “The Green Giant: New Industrial Strategy for Norway“.

The topic of the paper is how to more effectively use Norweigan resources, including the Norweigian Oil Fund, to effectively transition Norway from the 3rd largest oil producer to being a global leader in developing renewable energy technologies, and transitioning to renewable energy generation.

The main thrust of the report is “Norweigian oil revenues and opportunity for investment are going away anyway, and here are some ideas on how to not let that harm the Norweigian economy”.

There is one paragraph in their report I wish more people understood. It’s not specific to Norway, but rather is a general principle:

The finance and financial structure of an economy are not neutral; the type of finance received affects the

Kattel, R., Mazzucato, M., Algers, J. and Mikheeva, O. (2021). The Green Giant: New Industrial Strategy for

types of investments made and the type of economic activity pursued. In particular, there is an important

difference between types of finance that are conducive for investment in the real economy and speculative

finance which prioritises low-risk, short-term capital gains through the trade of existing assets.

Transformation of economic structures implies re-orienting financial flows – through regulation, financial

innovation, institution-building and deliberate policy coordination – towards investments in the economic

activities that are essential for the structural change to occur.

Norway. UCL Institute for Innovation and Public Purpose, IIPP policy report (PR 21/01). Available at:

https://www.ucl.ac.uk/bartlett/public-purpose/pr21-01

The structure of the government of Norway

Norway is a constitutional monarchy. The current monarch is King Harald V, who became king in January of 1991, after succeeding his father.

The government (which in the USA would be called the Executive branch) consists of the Prime Minister and his Council of State (the Statsråd).

The members of the government are nominally chosen by the monarch and are approved by the Storting, the national legislature.

The legislature used to consist of two houses, the Lagting was the upper house and the Odelsting was the lower house, but in 2009 the upper house was dissolved and the Storting became a single chamber, which consists of 169 elected representatives.

The judiciary is a separate branch of government.

The political climate

The immediate post-WW2 political climate in Norway was overshadowed, or strongly influenced by, a purge against people who were considered to have been Nazi collaborators. This lasted from May of 1945 to August of 1948 and resulted in the execution of 25 people and the imprisonment of about 19,000 others.

Side note: The dark-haired woman in ABBA (Anni-Frid Lyngstad) was born in Norway in 1945 and moved to Sweden with her mother and grandmother during this purge as her biological father was a German soldier. So in an indirect way, the Nazi occupation of Germany helped give the world ABBA.

Like other European countries, Norway elected a more left-leaning government after WW2. The Labour (DNA or Det Norske Arbeiderparti) party won a majority government in 1945 and ruled continuously until 1965.

During this time the Labour party enacted some of what we’ve come to recognize as the nordic welfare state: old-age pensions became universal, a mandatory earnings-related national pension plan came into effect, and an old “poor law” was replaced by a location on national welfare assistance.

From this point, Norway has gone “back and forth” between the Labour party and more conservative parties, with coalition governments being fairly common.

In 1965 a more conservative coalition government was formed.

In 1971 this coalition government split and the DNA again formed the government.

This DNA government was dissolved after a referendum on the European Economic Community, and then returned to power in 1973.

In 1981 another conservative coalition government was formed.

In 1986 the DNA again formed the government.

In 1989 another conservation coalition government was formed, which lasted only one year,

In 1990 another DNA government was formed.

In 1997 a center coalition government was formed led by the Christian People’s Party.

In 2000, a Labour party minority government was formed.

This back and forth between Labour and Conservative governments still continues.

If you remember the horrific shooting in Norway in 2011 where 65 people were killed… It had some political overtones, as it occurred at a Labour party youth camp.

It seems Norway has never been quite as “leftist” as Denmark and Sweden, although it also feels inaccurate to think of them as conservative.

The Wikipedia page devoted to the political parties in Norway lists 29 parties, 10 of which currently hold seats in the Norweigan parliament. The current coalition government is led by the Labour Party.

Norway is not in the European Union, so has no representation in the European Parliament.

Norway has access to the EU’s single market by being a member of the European Economic Area without being a member of the European Union. Iceland and Liechtenstein are also in the EEA without being in the EU.

The business sector

The Heritage Foundation who provide a ranking of “economic freedom” for 169 nations on earth ranks Norway as #28, which puts them in the category of “mostly free”.

The Sustainable Governance Indicators also rank nations, and they rank Norway #10 globally for “economic policies” citing their acknowledgement that oil revenues will not continue forever, their long term plan to transition away from a dependency on oil and gas revenues, labour-market policies with an emphasis on retraining long-term unemployed, and their high individual and low corporate tax rates.

Trade unions

Trade union membership in Norway is 52%, which while high by the standards of many industrial nations, is the lowest rate among the Scandinavian countries.

Government corruption

Transparency International, a global organization that ranks public sector corruption, gives Norway a Corruption Perceptions Index rank of 7, which ranks Norway as one of the 7th least corrupt nations on earth.

The legal system

Norway has a civil law system that incorporates the international agreements Norway is party to; the Human Rights Act, the European Convention on Human Rights, the International Covenant on Civil and Political Rights, the International Covenant on Civil and Political Rights, and the International Convent on Economic, Social, and Cultural Rights.

Norway has a four-tier judicial system. The lowest level court for civil matters is the conciliation board, which is both a mediation body and a court. If mediation is not successful, civil cases move to the district courts, appeals are heard by the appeal courts, and there is a supreme court. Criminal cases start in the district court.

Norway has an interesting feature where citizens of Norway participate in court cases as “lay judges”, who provide a counterbalance to “official power and the establishment”. Cases are heard by 1 professional and 2 lay judges. I found one exception to this which was the Brevik case mentioned earlier where one person (Brevik) killed 77 people at a Labour Party youth camp. His case was heard by 2 professional and 3 lay judges.

The banking system

The banking system in Norway consists of the central bank (Norges Bank), 17 commercial banks, 105 savings banks, and a small number of state-owned banks.

Oversight and regulation of Norway’s banking system is the responsibility of the Financial Supervisory Authority of Norway, which handles licensing, supervision, and reporting.

Norway has three types of banks:

- Commercial (business) banks

- Savings banks

- Branches of foreign banks

Moody’s rates the outlook for Norway’s banking system as stable, which considering that banking should be reliable, seems like a good thing.

Government regulation of the economy

Norway has never had a hands-off laissez-faire government non-intervention set of policies of the economy. The economy has always been intentionally shaped by government intervention.

Considering how highly ranked Norway is by various organizations who rank governments and economies, that intervention has overall (but not always) been positive for most Norwegians. One often-cited example of poor policies is the Norweigian government policies for the fishing industry.

Some notable characteristics of government intervention in Norway’s economy are:

- The oil company is stated owned.

- Oil revenues have been invested into the worlds largest sovereign wealth fund, which pays part of Norway’s central government budget.

- Foreign direct investment is encouraged, AND scrutizined.

- The welfare state is fairly generous.

Taxation

Taxes in Norway are levied by the central government, county municipalities, and municipalities.

General income, which includes income from employment, business, and capital, is taxed at 22%. There are bracket taxes on personal income above this amount:

- NOK 193,350 to NOK 267,900 (USD $21,500 to USD $30,300) is subject to a bracket tax of 1.7%

- NOK 267,900 to NOK 643,800 (USD $30,300 to USD $72,800) is subject to a bracket tax of 4.0%.

- NOK 643,800 to NOK 696,200 (USD $72,800 to USD $78,700) is subject to a bracket tax of 13.4%.

- NOK 696,200 to NOK 2,000,000 (USED $78,700 to USD $226,300) is subject to a bracket tax of 16.4%.

- Income above NOK 2,000,000 (USD $226,300) is subject to a bracket tax of 17.4%.

Norwegian citizens pay incomes tax on all income earned worldwide, while non-Norwegian citizens residing in Norway pay tax only on income earned in Norway.

Norway also has a wealth tax paid on the value of your net worth. How much one pays obviously depends on their net worth.

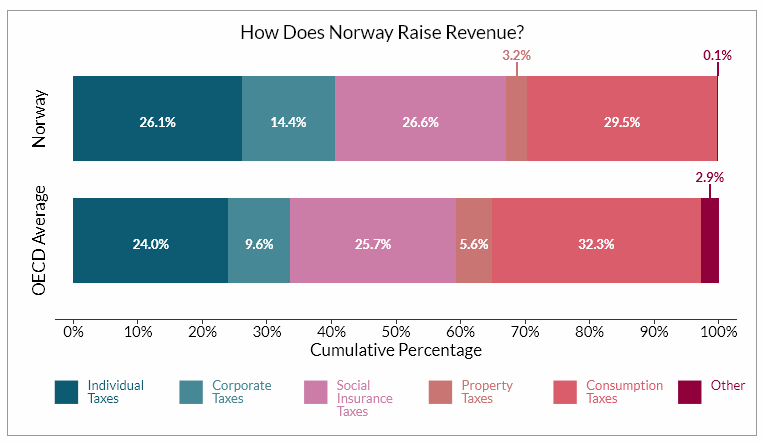

The Tax Foundations International Tax Competitiveness Index (ITCI) ranks the 36 OECD countries on how low their taxes on business investment are, and they score Norway as 10th. Norway has lower corporate income taxes than most nations with a current top corporate income tax rate of 22% and 14.4% of tax revenue coming from corporate income tax.

The chart below shows sources of tax revenue for Norway compared to other OECD nations.

Healthcare

Norway has universal healthcare, funded through taxes and payroll contributions. Enrollment is automatic and the services provided are extensive.

Healthcare responsibilities are split between levels of government. The national government provides hospital and specialty care. Primary, preventative, nursing, and long-term care are provided locally.

Public health insurance is funded mostly through national and municipal taxes (76%) and state payroll taxes (11%).

Private health insurance is available and provides quicker access to outpatient services and a greater choice of private providers, but they cover less than 5% of elective services.

Education

The Norwegian school system is divided into three parts: elementary (ages 6 through 13), lower secondary (ages 13 through 16), and upper secondary (ages 16 through 19). The upper secondary has two distinct tracks: vocational studies or general education. Upper secondary school is a right, but not an obligation.

One-third of Norwegians now obtain University degrees, partly due to how affordable it is. Most universities do not charge tuition, even for foreigners studying in Norway. The Norwegian demographic with the largest percentage taking university classes are women aged 30 to 39.

Natural resources

Norway is blessed with an abundance of natural resources, well beyond the oil and natural gas everyone knows about.

Norway has rich deposits of nickel, pyrites, titanium, lead, copper, zinc, and iron ore, as well as a continental shelf where fishing rights extent out 200 miles.

Having been a seafaring society for well over a thousand years, it’s not surprising that today Norwegian interests control the world’s third-largest maritime shipping fleet which comprises about 10% of total global maritime shipping.

Direct government support and intervention

From what you’ve read above, no one could ever view the Norweigian government as taking a hands-off approach.

They own the national oil and gas company, own the world’s largest sovereign wealth fund, support trade unions, strictly regulate banking practices, screen foreign direct investment for national security risks, and in many ways takes a very hands-on approach to industrial and economic policy. Norway also provides subsidies for their agricultural sector, as well as imposes tariffs on agricultural imports.

Foreign direct investment

Norway has a history of accepting/allowing foreign direct investment to where they are ranked 9 out of 190 countries in the World Bank’s 2019 Doing Business Index. There are around 7,400 foreign-owned firms in Norway.

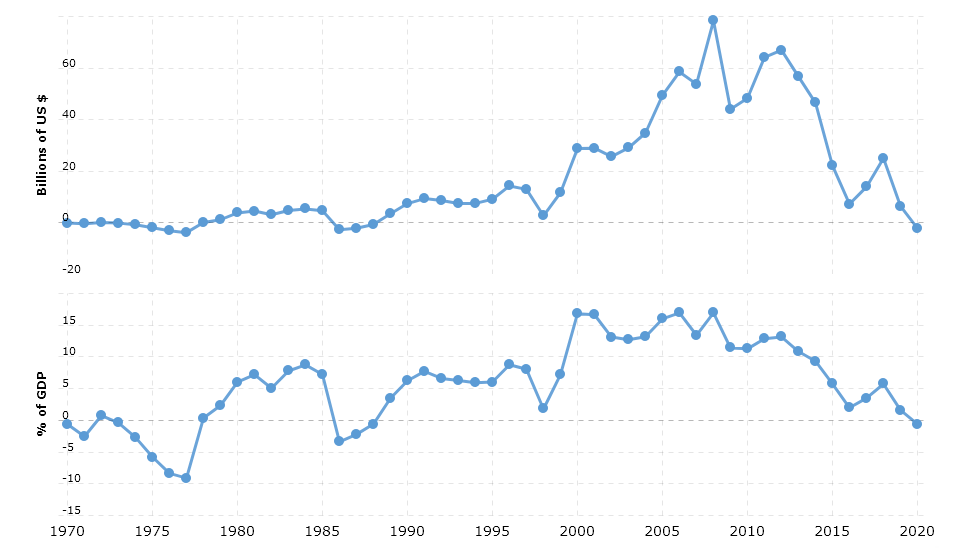

As the chart below shows since 1970 Norway has consistently been a recipient of investment inflows, except for a strong but short dip in the year 2016. Since 1994 Norway has attracted net foreign direct investment in the range from 0% of GDP to 6.2% of GDP, excepting of course for the aforementioned dip in 2016.

Important intra and inter country partnerships

The many partnerships Norway has with other nations is detailed above in terms of the various international agreements they are party to, which is extensive.

Tracking intra-country partnerships that are important to economic prosperity is more elusive, but the generous welfare state, the strong support of trade unions, the tuition-free post-secondary education, etc all mirror important intra-country partnerships common in the other Nordic nations.

It is fair to say these partnerships add to the economic prosperity of Norway by taking a long-term perspective as regards economic policies.

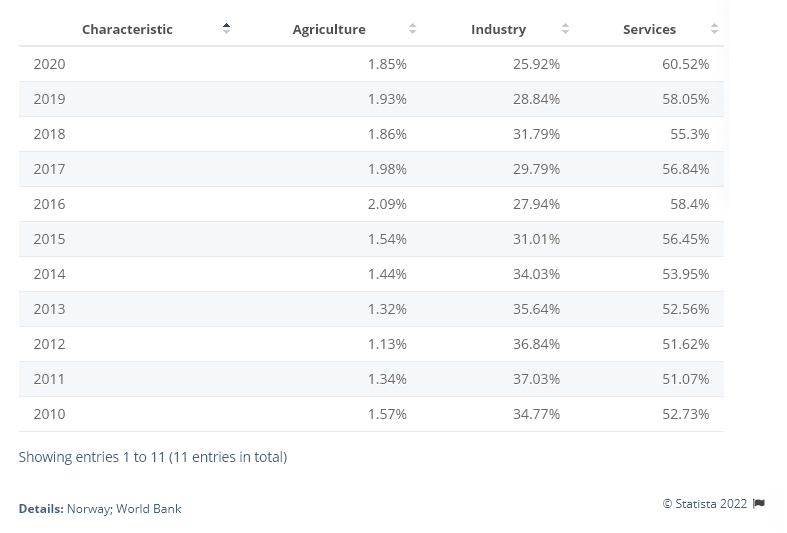

GDP by sector

The most granular data I can find on the GDP of Norway by sector shows the percentage of GDP from agriculture, industry, and services. As you can see from the chart below, Norway is predominantly a service-based economy and has been so for since at least 2010. In fact, the GDP breakdown for Sweden and Norway are very similar.

The balance of trade

Norway has exported more than it imports pretty consistently (but not every year) since 1978, and since then the balance of trade surplus has been in the range of -3.38% (1986) to 16.9% of GDP (2008), but interestingly dropped to -0.59% in 2020, the last year for which data is reported.

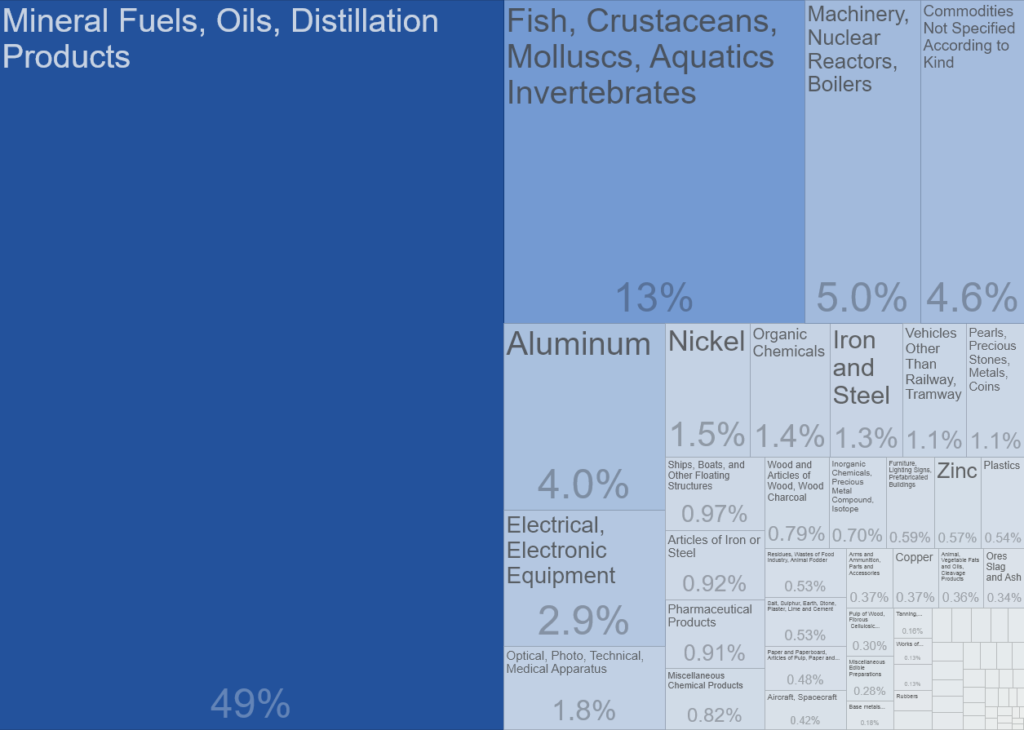

Exports by sector

The chart below shows the importance of mining and minerals to the Norweigian economy is, above and beyond the importance of oil and natural gas. It illustrates the importance of commodities to the trade surplus, which surprised me as the economy is so services-based.

Wealth and income inequality

The most widely used measure of income distribution is the Gini index. It condenses several data points into a single number from 0 (perfect equality) to 1 (perfect inequality), although it is sometimes expressed as a number between 0 and 100.

The Gini value for Norway for 2018 (the most recent the World Bank website provides a value for) was 27.6, which is one of the more equal economies on earth. although Norway’s score rose rather sharply in 2003 and has recovered since then.