This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or Nordic) nations from the end of WW2 to today, and summarize what I’ve learned into these blog posts.

Why am I doing this? Because the ongoing debate about “Scandinavian socialism” vs “Scandinavian capitalism” interests me. I’m curious for information devoid of ideological rhetoric.

If you found this post via an Internet search, it probably makes sense to start with the first post in this series, the link to which is both above, and here.

Table of Contents

A summary of major economic changes, 1945 to the present

Iceland deserves recognition as one of, if not THE, only nation to respond to the 2008 great financial crisis by the direct government takeover of the largest banks, allowing the three largest banks to fail, and issuing arrest warrants for bankers. More on this later, but this was such a different response relative to other nations that it deserves special mention.

Pre WW2

Before WW2, Iceland was a sovereign kingdom in personal union with Denmark. As someone who doesn’t really understand monarchy well, I don’t really know what that means, but I do know that the economy of Iceland was supported by fish, sheep, and geothermal energy. Fish was sufficiently important that apparently, a famous Icelandic saying is “Life is salt fish“, which I do understand having lived two years in Newfoundland as a teenager, someplace else where salt fish is (or at least was) a staple.

WW2

At the start of WW2, Denmark and Iceland were both officially neutral. Communications between Denmark and Iceland were severed on April 9, 1940, when Germany invaded Denmark.

On May 9, 1940, the United Kingdom declared their intention to defend Iceland if Iceland would allow British troops to establish a base in Iceland, which Iceland rejected, preferring to remain neutral. However, Britain took possession of Iceland in an uncontested invasion which consisted of 400 British soldiers coming ashore and meeting no resistance from 70 police officers. Britain (and later the US) saw Iceland as a strategic location from which to protect merchant fleets crossing the Atlantic.

On June 16, 1940, Canadian troops arrived, were reinforced by more on July 9 and took up defensive positions on the island.

Britain wished to use their forces elsewhere and asked the Americans to take over, as both the US and Iceland were officially neutral (Pearl Harbour had not happened yet). American forces started arriving in July of 1941.

During this occupation, on 17 June 1944, Iceland declared itself an independent republic, remained officially neutral in the war, and continued to help the British, Canadian, and American militaries.

This military occupation of Iceland during WW2 was a boom for the economy of Iceland, as these militaries brought money and employment to the island. According to one study, the military occupation of Iceland during WW2 alone transformed Iceland from one of the poorest countries in Europe to one of the richest.

Immediate post WW2

When you read the history of Iceland after WW2, not much is said. The end of the war was not as dramatic for Iceland as it was for other European nations, likely as a result of playing a supporting role for the winning side, and not being directly involved in the fighting.

There is however one post WW2 economic change that I think merits mention; The Cod Wars (not to be confused with the Cold War).

As demand for seafood grew, Icelandic fisheries became concerned that overfishing would deplete fish stocks, so in 1951 Iceland expanded its territorial waters to 4 nautical miles to keep British fishing vessels away.

This started the first Cod War between Iceland and the UK. There would be a total of four Cod Wars and somehow Iceland won them all.

This was a policy of protectionism, and it seems to have worked, allowing the Icelandic fishing industry sole control of harvesting of fish within 200 nautical miles of Iceland (by the end of the 4th one).

The Marshall plan

Iceland was a direct beneficiary of The Marshall Plan, and due to their small population, the $43 million they received made them the largest per capita beneficiary.

International institutions

Iceland is a member of a long list of international organizations. They joined the UN in 1945 (but waited until 1965 to establish a permanent mission) and later joined the International Monetary Fund and the World Bank, and in the 1990s they joined the World Trade Organization.

The quiet period: Post WW2 to “securitized fishing quotas”

“The quiet period” is my label. When you read up on the economic history of Iceland, from the end of the Marshall plan to the build-up to the great financial crisis in the 2000s, not a lot is said.

For that reason, I call this time “the quiet period”. While there were ups and downs, they were nothing compared to what was coming.

Securitized fishing quotas

And what was to come started innocently enough.

With the use of motorized fishing boats, and the ability to harvest fish faster, there were concerns the waters around Iceland would be overfished.

So fishing quotes were enacted. They were called Individual Transferrable Quotas (ITQs) and they were a new form of property. They could be owned, sold, leased, traded, etc.

IRQs were implemented on herring in 1976, groundfish (or demersal fisheries) in 1984, nearly all fisheries in 2004, and all commercial fishing vessels in 2004.

ITQs turned out to be a blessing and a curse. ITQs did help Iceland maintain profitable fisheries without depleting future fish stocks, but as “tradeable property” they are considered to have brought Iceland into the age of Money Manager Capitalism where things that could be securitized were securitized.

Although, perhaps ironically, after Iceland was devastated by the 2008 global financial crisis, the Icelandic fishing industry remained strong and viable, which is credited to the prior implementation of ITQs.

From ITQs deregulated banks

The implementation of ITQs coincided with the spread of neoliberalism over the industrial world. In Iceland, as elsewhere, banking regulations were relaxed.

This, in turn, allowed for more creative financing strategies, which included banks keeping small cash reserves and borrowing heavily to finance the purchase of foreign securities.

To WTF?

The banking system in Iceland grew from 100% of GDP in 1998 to 900% of GDP in 2008.

As neoliberalism allowed looser banking regulations, Icelandic banks did what other banks did, which is they stopped holding loans and started repacking them and selling them. Thereby offloading the risk to others through collateralized debt obligations (CDOs).

The banks originating and repacking the loans incurred risk only until the CDOs were sold. As such, to them, the creditworthiness of the borrowers wasn’t that important, which led to loans being made to people who couldn’t pay.

Yet these loans were used to support the creation of bonds that were sold in the European and US bond markets. By 2008 these bonds represented 40% of the bank’s balance sheet and had three times the value of Iceland’s 2007 GDP.

Moody rated the bonds highly, which helped create demand for them.

Icelandic banks also paid higher interest on deposits and in 2006 started accepting deposits from abroad. Specifically Britain and the Netherlands. By 2008 foreign deposits increased to over 16 billion euros, equally about 15 percent of the banks combined balance sheets.

In mid-2007, the Icelandic banks started increasing cash on hand using central bank repurchase agreements of central bank bonds. This is a common feature of modern banking and at face value not necessarily a problem. However, each repurchase agreement is a liability the bank must repay, which in theory is backed by a high-quality bond.

However, Icelandic banks created low-quality highly rated bonds through a “love letter” exchange. Two banks would exchange bonds with each other, then use those bonds as collateral for repurchase agreements with the Central Bank of Iceland (CBI) and the European Central Bank (ECB).

This effectively reduced any barriers to how much could be borrowed from the central banks, as there was no limit to how many “love letter” bonds banks could create.

In April of 2008, ECB figured out this love letter scheme and alerted the governor of the CBI. By August of 2008, the ECB had replaced these love letter bonds with Icelandic bank CDOs (which were themselves worthless due to lax underwriting standards), but the CBI continued to accept love letter bonds as collateral.

So, where did all that borrowed money go?

Disproportionately, to firms and companies tightly connect to the bank’s owners. This was not seen in advance due to the complex ownership structures that made this opaque.

How do the Icelandic banking regulators know all this? After the crash, they spent a year pouring over banking records to reconstruct what happened, how, and when.

To the bursting of the bubble

The Icelandic banks were increasingly operating in foreign currencies, but their lender of last resort was the Central Bank of Iceland, which could only provide Icelandic krona.

And foreign currency deposits were eight times the banking reserves.

So there was no way for the CBI to bail them out. They owed too much in currencies the CBI did not issue.

And when foreign depositors started withdrawing their money, it became a classic bank run, with the banks being unable to provide the depositors with their money.

One of Iceland’s largest banks, Glitnir, was not going to be able to pay a large loan maturing in October of 2008. The bank’s board asked the CBI for assistance. The Icelandic government took over 75% of the bank’s equity, which rattled financial markets.

Finance analysts could easily see the CBI was not big enough to bail out the bank’s liabilities, and this created an actual run, as foreign depositors tried to withdraw money while there was money to be withdrawn.

The Icelandic government took over all three of the largest banks within a week and split them into two, a domestic half that took over domestic deposits which were fully guaranteed, the other for non-domestic deposits that were not fully guaranteed.

The splitting involved the creation of new banks, some for domestic lending, others for foreign lending.

The governments of the UK and the Netherlands demanded that all deposits be insured up to the minimum deposit insurance amount. The Icelandic government countered by saying the fund which had that responsibility was insolvent after the systemic failures of the Icelandic banking system. This dispute was settled in the European Free Trade Association’s court a few years later, and weirdly (in my opinion) the government of Iceland won on technical grounds, that being that the deposit insurance guarantees were never intended to cope with a systemic banking failure of such magnitude.

Output loss

Output loss is a measure of how the true productive output of an economy reduces. Financial crises cause output losses as production is generally financed. No borrowing, no production. After the crash, the output loss of the economy of Iceland was about 40% of GDP, which is huge. Some economists ranked 147 financial crises, and the Icelandic output loss ranked as 34th costliest.

The recovery

It is generally held to be true that recovering after a banking crisis takes a long time, and that the more debt is involved, the longer it takes, as that debt needs to be resolved.

When Iceland created new banks when the big three were split in two, they wrote off assets in bulk. Later, the Icelandic supreme court determine that the loan contracts linked to foreign currency offered by the banks before they failed were illegal so that debt also disappeared.

As well, the Icelandic krona devalued by 50% relative to the euro, which made Icelandic exports cheaper for buyers in the eurozone, which helped fuel the recovery, and may also have fueled an influx of tourists, whose money now bought more in Iceland.

For a variety of factors, the Icelandic recovery was much quicker than most economists expected.

The structure of the government of Iceland

Iceland is a constitutional republic with multiple political parties.

The head of state is the President. The head of the government is the Prime Minister. Executive power rests with the prime minister and their cabinet.

The president has input to the legislature, which is the 63 people Althingi, which is elected every four years by secret ballot.

For the record, the Icelandic Allthingi was established in 930 AD making it the oldest legislative body on earth. Were you previously aware that the parliamentary democracy was created by the Norse during the Viking era?

The judiciary is the third branch of government.

The political climate

Iceland is currently a coalition government led by the Independence Party whose ideology is categorized as “liberal conservatism” which in the USA isn’t even a valid ideology. The core principles of liberal conservatism seem to be fairly limited government with a strong welfare state, which to people in some countries seems like a contradiction. But not in Iceland.

Currently, there are 9 parties with seats in the Icelandic legislature (the Allthig) out of a total of 18 parties. Even the Pirate Party, an interesting party pushing for direct democracy, holds 6 of the 63 seats.

Iceland has a history of coalition governments, and sometimes selects prime ministers from one of the smaller parties in the ruling coalition, which is the case now. The current prime minister is the leader of the Left-Green Movement, which holds 8 seats, whereas the other two parties each hold more seats in the coalition. The Independence Party has 16 seats and the Progressive Party has 13.

The business sector

As Iceland has a small population, the business sector of Iceland is also small. The Heritage Foundation, which ranks nations according to what they call economic freedom, ranks Iceland as the 23rd freest economy on earth.

The World Bank maintains a DoingBusiness profile on 190 countries, where they measure business regulations for local firms. They rank Iceland high except for two areas: enforcing contracts and resolving insolvency.

While the descriptions of how they measure this are generic, I suspect those two low scores are related to how Iceland responded to the 2008 global financial crisis where they allowed their three largest banks to fail and won in court to allow non-Icelandic residents to lose their deposits in the process. If your interest is protecting creditors over debtors, those are bad.

One thing I don’t get personally is since Iceland generates about 100% of its electricity from hydropower (73%) and geothermal (27%), why aren’t there more than 9 colocation data centers in Iceland, and why is 9 thought of as a booming data center industry?

Trade unions

The Nordic Cooperation website claims that in Iceland “almost all workers are members of a union“, which Iceland Magazine quantifies as 79% of all wage earners belong to a union and 89% receive wages based on a union contract.

This is much higher than the 17% union membership across all OECD nations.

Government corruption

Transparency International, a global organization that ranks public sector corruption, gives Iceland a Corruption Perceptions Index rank of 17, which ranks Iceland lower than the other Nordic nations, but still the 17th least corrupt government out of 180 nations ranked.

The legal system

Iceland changed to a three-tier court system in 2018, where the mid-level, the court of appeal, was the new addition.

Cases (both criminal and civil) start in district courts. Appeals are heard in the court of appeals, and the top tier is the supreme court.

As the population of Iceland is small, the judiciary is too. There are 64 judges in Iceland, 42 of whom preside over the 8 district courts. The court of appeal has 15 judges, and the supreme court has 7.

The banking system

As you saw above, the Icelandic banking system was drastically reorganized after the 2008 global financial crisis.

The central bank of Iceland is called, boringly enough, The Central Bank of Iceland (CBI). Iceland has a sovereign currency, the Icelandic krona, which is issued by the CBI.

As mentioned above, after the 2008 global financial crisis, the three largest banks in Iceland were taken over by the government. While shares of those banks can now be bought on stock exchanges, the bulk of shares are still owned by the Icelandic government.

Iceland has three commercial banks (Arion Bank, Islandsbanki, and Landsbankinn) and one investment bank (Kvika).

All banks provide similar commercial banking services, but financing for large-scale projects tends to come from foreign banks, and presumably are denominated in foreign currency.

Government regulation of the economy

Hindsight is 20/20 vision, and clearly, prior to 2008, the regulation of the banking system was flawed. Dealing with the immediate aftermath of the crisis involved very heavy government involvement of the banking sector, and the imposition of strict banking regulations. Things have now relaxed with the abolition of capital controls in 2017.

Taxation

Like the other Nordic nations, taxes in Iceland are higher than in other industrial nations.

There are only three tiers of personal income tax, and the percentage below is the combined tax of the central government and the muncipal government.

- Up to ISK 4,188,211 (USD $32.360): Income tax is 31.45%

- On the next ISK 7,569,948 (USD $58.510): Income tax is 37.95%

- On all income above that: Income tax is 46.25%

Corporate taxes for LLCs and limited partnership companies is 20% and taxes for other types of corporations is 37.6%.

Capital gains tax is 22%.

A general Value Added Tax is 24% but some products have an 11% VAT.

The pension fund tax is 12% and is paid 4% paid by the employee and 8% paid by the employer.

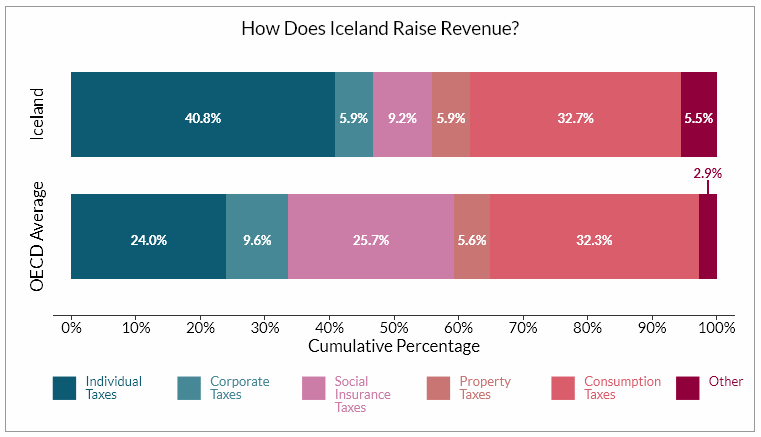

As you can see from the chart below sources of tax revenue for Iceland are much more reliant on individual taxes compared to other OECD nations. I’m not sure if this a proactive policy or because the Icelandic business base is smaller.

Healthcare

Iceland has a universal healthcare system consisting of one main hospital (again, small population), seven healthcare districts, each one of which operates healthcare services for the district.

I found no information on how the system is funded, other than “via taxes”.

Education

In a 2016 study, Iceland was ranked the third most literate nation on earth.

Preschool is available, but not compulsory, from ages one to six. There are fees and they are subsidized.

Compulsory education is free and is from age six to age 16. Homeschooling is not an option in Iceland.

Upper secondary school is available to anyone who finished the compulsory education, students are from 16 to 20 years of age, and is also free, except for one private school.

University is available to anyone who has completed upper secondary. Public universities are tuition-free, but there are modest registration fees.

Natural resources

Fish – of course. Fish is so important that Iceland “fought” and won, the Cod Wars against the UK. So if you want REALLY good fish and chips, go to Iceland, not England.

Renewable energy in the form of hydroelectric and geothermal which is produced domestically, provides 85% of Iceland’s electricity usage, and almost 90% of Icelandic homes are heated with geothermal water.

Water, which Iceland now exports.

And believe it or not, aluminum. Iceland exported USD $1.61 billion of aluminum in 2020, which works out to about $4,600 per person.

Direct government support and intervention

See above. Fishing quotes. Full nationalization of the countries biggest banks. Stiffing foreign depositors. Capital controls. No one could EVER accuse the Icelandic government of taking a hands-off approach unless you want to chastise them for the weak banking regulations that allowed the pre-2008 great financial crisis fraud to go undetected until it was too late.

Foreign direct investment

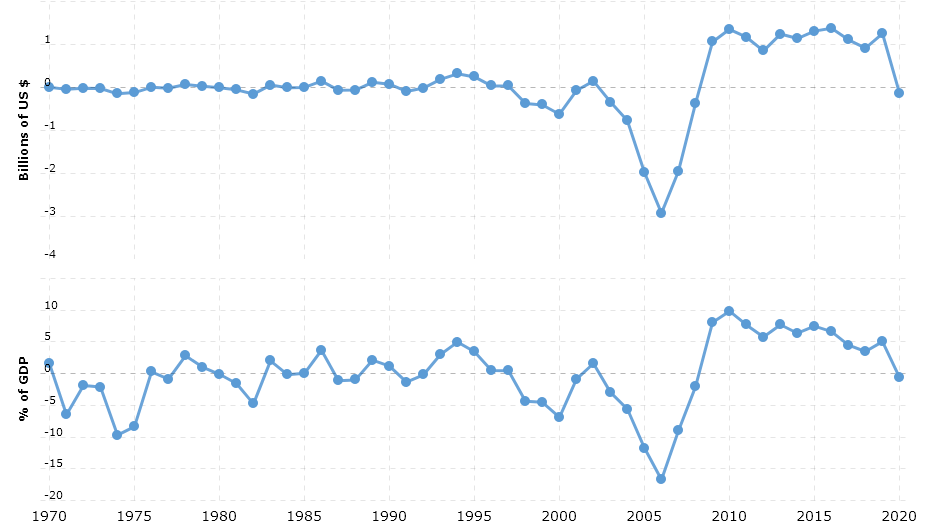

Iceland is ranked 26th out of 190 countries in the World Banks Doing Business Index and in the chart below you can CLEARLY see the pre-2008 crash bubble form and burst.

Since then foreign direct investment in Iceland has fluctuated greatly, peaking at 7.3% of GDP in 2011 and dipping at -28.3% of GDP in 2017.

Important intra and inter country partnerships

Iceland is pretty standard for all the other Nordic countries, just on a smaller scale. The government is heavily involved in managing the economy, strong trade unions are supported by the laws of Iceland, and Iceland has a Nordic style (generous by the standards of most countries) welfare state, which they pay for with higher taxes.

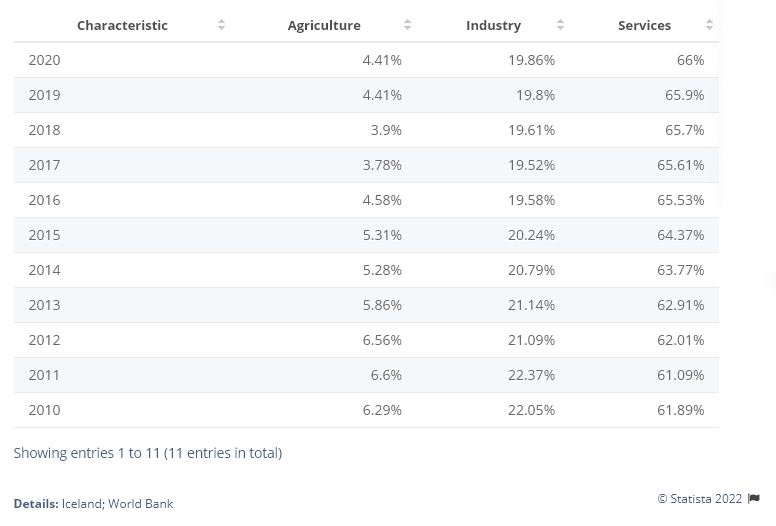

GDP by sector

The chart below looks very like the other Nordic nations whose economies are dominated by services. In the case of Iceland, their agricultural and services sectors are larger and their industrial sector is smaller.

The balance of trade

Why would the bubble leading up to the 2008 crash involve a spike in imports? What were they importing? Is it just that they felt flush with riches due to the wealth effect of the asset bubble? Did they in fact have much more disposable income? Or did they import stuff to create future exports? I’m not finding this answer.

However, the increased exports after the crash made sense, as they sold whatever they could to bring in foreign currency. I also don’t understand the dip in 2020 but since that’s the last year on the chart, I can’t tell if it’s temporary.

Exports by sector

The high reliance on seafood for exports makes sense, but I had no idea quite how important aluminum was to the Icelandic economy until I saw this chart.

Wealth and income inequality

The most widely used measure of income distribution is the Gini index. It condenses several data points into a single number from 0 (perfect equality) to 1 (perfect inequality), although it is sometimes expressed as a number between 0 and 100.

The Gini value for Iceland for 2017 (the most recent year the World Bank website provides a value for) was 26.1, which is one of the more equal economies on earth. although Iceland’s score rose in 2008 (surprise surprise) it has recovered nicely since then.