This blog post is a summary (of sorts) of a podcast episode: Macro and Cheese Episode 42 – Repo Mania: Has The Fed Bailed Out Wall Street Again? With Nathan Tankus.

The keyword in the above sentence is SUMMARY. I encourage you to listen to the full episode.

You can listen to the full podcast via the link above, or via the audio widget below.

But first, before we get into the details, a few definitions will help greatly.

But before that, here is the featured image credit.

Table of Contents

Definitions needed to understand the federal reserve system

Repos and Reverse Repos: Repurchase and Reverse Repurcahse Agreement

Repos (repurchase agreements) are very short-term loans the Federal Reserve makes to primary dealers. Reverse Repos (reverse repurchase agreements) is the opposite, where the primary dealers make the short-term loans to the Fed.

A repo is where a primary dealer sells Treasury bonds to the Fed and buys them back the next day. In exchange for the bonds, the primary dealers receive settlement balances. The repurchase typically occurs the next day, but the repurchase can stretch out as long as 65 days.

Another way to describe repos is the Fed loans money to a primary dealer who provides Treasury bonds as collateral.

A reverse repo is the opposite. A primary dealer buys Treasury bonds from the Fed and sells them back the next day. In exchange for the bonds, the Fed receives settlement balances. As with repos, the repurchase typically occurs the next day.

Another way to describe reverse repos is the Fed borrows money from the primary dealers and provides Treasury bonds as collateral.

Repos and reverse repos are part of the commercial banking payment clearing system, whereby banks who have an excess of settlement balances loan them (with the Fed as an intermediary) to banks who have too few.

Reserves (aka Settlement Balances)

This is money kept by commercial banks which are used to settle payments.

Primary Dealers

Primary dealers are “trading counterparties” of the Federal Reserve. They have a very privileged place in our banking system. To be a primary dealer an institution must agree to participate in all Treasury auctions, buy Treasury bonds at auction, and resell them to their customers. I say this is a “privileged place” as they make money every time the US Treasury sells bonds, which they do every time the US Congress passes a bill that requires funding.

Quantative Easing

Quantitative easing is a monetary policy tool in which a central bank increases the money supply by adding new money into an economy by buying long-term government securities on the open market.

What does the Federal Reserve do?

Their primary responsibilities are setting and maintaining a target interest rate, and ensuring that payments made through the commercial banking system clear.

Repos and reverse repos are part of making system payments clear.

Banks need reserves (settlement balances) to accommodate people who come to the bank and withdraw cash.

Reserves are also part of the rules of banks making loans.

However, inadequate reserves do not constrain the ability of banks to make loans. When the bank has a good loan candidate, they make the loan, find themselves with inadequate reserves, then borrow money from the banking system (directly from the Fed) by executing a repo with the Fed.

Having said that, in March of 2020, the reserve ratio of the US banking system was dropped by zero percent. So, for the time being, the Federal Reserve rule needing banks to obtain more reserves after making loans has temporarily been suspended.

Why are people so concerned with repos these days?

Because the system broke in 2008.

The idea behind the system is that banks with excess reserves lend their excess reserves to banks with inadequate reserves, using the Fed as an intermediary.

In the early days of the global financial crisis, it was not clear which banks would fail, banks had been making unsecured loans, banks felt a strong need to hold onto whatever cash they could, and bank lending ground to a halt.

If banks aren’t making loans, banks don’t need more reserves, so most if not all banks in the system found themselves with excess reserves.

This caused the market in which repos and reverse repos were exchanged to shut down.

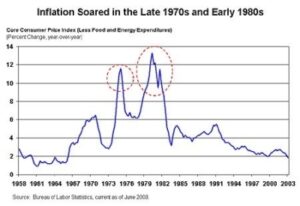

After things stabilized somewhat, the central bank felt the need to inject liquidity (cash) into the commercial banking system, so they started buying Treasury bonds at volume through a program called Quantitative Easing.

This injected so many reserves into the banking system that repos weren’t needed for several years. Then when repos started happening again, people got concerned.

Then, as part of our response to Covid, in March of 2020, the Fed reduced the reserve requirement to zero percent, and several months later a massive set of reverse repos were executed that effectively removed reserves from the banking system, presumably since they’re not currently needed.

These vary large reverse repos seemed concerning to some people.

Also, note that the reverse repo activity shown below occurs after the repo activity shown above.

How has the repo market historically worked?

It seems the work was done either primarily or exclusively by the New York Fed.

Every day, people at the New York Fed would produce an estimate of demand for settlement balances within the banking system.

This estimate would be created by surveying banks and asking questions and to create their daily estimate they would monitor inflows and outflows to the Treasury’s reserve account at the Fed as well as orders for physical bills and coins at commercial banks.

Based on their daily estimate, they would enter into enough repurchase agreements, and thereby transfer reserve balances into the accounts of the primary dealers, to ensure there were just enough settlement balances in the banking system to ensure that payments would clear, those reserve requirements would be satisfied, and that they (the Fed) would hit their interest rate target.

Repos, reverse repos, and hitting the target interest rate

As stated above, one of the Fed’s primary missings is to set and maintain a target interest rate.

If there were insufficient reserves in the banking system, banks who needed reserves would bid against each other for reserves, and to ensure they have enough, they would offer to pay more, which means they would pay a higher interest rate.

After the long gap of excess reserves in the system, the Fed has returned to a system of repos and reverse repos that is slightly different from the pre global financial crisis system, but not in any significant way.

What is meant by “liquidity” in the banking system?

It refers to the ability to meet monetary payments, either by having the cash in a federal reserve account, being able to quickly sell an asset in exchange for such balances, or being able to add to such balances by quickly borrowing against an asset.

What is the Basel III agreement?

First, what is the Bank for International Settlements?

The Bank for International Settlements is effectively the central bank for central banks.

They facilitate payment processing across what I’ll call “currency borders”. I said currency borders intentionally rather than national borders because 19 separate and somewhat independent nations within the eurozone all use the same currency.

Additionally, on occasion, a small nation chooses for their official currency to be the currency of some other nation. For example, the official currency of El Salvador is the US dollar.

The Bank for International Settlements was established in 1930 and is headquartered in Basel, Switzerland, which is where the Basel III agreement gets its name.

Second, a brief primer on the Bretton Woods agreement

The Bretton Woods Agreement was negotiated in July of 1944 by about 730 representatives of 44 countries. The conference was held in Bretton Woods, New Hampshire, hence the name.

And while the conference itself occurred over a period of just three weeks, the discussions leading up to it took place over the past several years.

The Bretton Woods Agreement defined the rules for international finance.

It defined gold as money and pegged the value of national currencies to gold. For example, the US dollar was defined as one thirty-fifth of an ounce of gold, or to say it another way, the US dollar was convertible into gold at the fixed rate of $35 an ounce.

As all national currencies were pegged to gold, there were fixed exchange rates between currencies.

The International Monetary Fund and the World Bank were created out of the Bretton Woods Agreement.

This system dissolved in the 1970s as various nations went off the gold standard and exchange rates between currencies started to float.

The Basel III Agreement

After the Bretton Woods agreement dissolved in the 1970s, there was still a need for international payment processing and some shared rules about how banks needed to operate.

As the name Basel III implies, there were earlier agreements, titled Basel I (1988) and Basel II (2004).

The Basel III agreement started being implemented in 2015.

Some of the banking requirements spelled out in the agreement are:

- Capital requirements: How high must a banks net worth need to be relative to its assets?

- Liquidity requirements: How much highly liquid assets must a bank hold relative to its assets?

The Basel Agreements (or Accords as they’re actually called) are very interesting to me as they’re not part of the United Nations or any international treaty.

The Basel Agreement is a set of rules worked out by central bankers, which they’ve agreed that need to be adhered to. Additionally, these rules are defined by the central bankers of the world’s largest economies (or currency zones) and then the central bankers of smaller developing economies are pressured into adopting them.

How does Basel affect repos and reverse repos?

Basel III, defined after the 2008 great financial crisis, defines liquidity requirements for banking.

To understand the relationship between the Basel agreements and Federal Reserve reserve requirements, we need to cover two more definitions.

Liquidity Coverage Ratio

They created a concept of Liquidity Coverage Ratio or LCR.

This defines the amount of high-quality liquid assets a bank must hold relative to its estimated payment outflow over a thirty-day period.

Banks must have on hand AT LEAST enough high-quality liquid assets to cover thirty days of estimated payment outflows.

The purpose of this is to give central banks a 30-day window to assess and decide how they’re going to respond to any system-wide liquidity crisis.

Resolution Liquidity

This idea is less “solid” than the LCR, but the idea is that central bank reserve balances (settlement balances) are a lot more liquid than central bank debt or bonds.

And for that reason, banks should have sufficient quantities of reserve balances to meet their LCR requirement.

10% reserve requirement? 0%? 30 day LCR?

The “normal” reserve requirement for US banks is 10%. However, in March of 2020, it was dropped to 0%.

As a result of the post-2008 quantitative easing and the suspension of Fed reserve requirements, US banks have had an excess of reserves for several years.

However, per the Basel III Agreement, the 30 days estimated payments outflows are NOW required, and by far, it’s the largest of the liquidity requirements.

So, while the US banking system hasn’t had much need for repurchase agreements to maintain Fed reserve ratio requirements for the past several years, it does now in order to meet the liquidity requirements of the Basel III 30 day LCR requirement.

What are reserves anyway and what purpose do they serve?

The word “reserves” is commonly used in two different contexts.

- Bank reserves are the money central bank customers have on deposit (in reserve accounts) at the central bank.

- But within the context of “reserve requirements” reserves are capital requirements, which are “settlement balances”.

Reserves are one form of “settlement balances”

Settlement balances are, as the name implies, all about settling payments. Reserve requirements are really settlement balance requirements, which are needed to ensure that banks can meet their payment outflows.

Settlement balances are a form of liquidity requirements. The Basel III Liquidity Coverage Ratio is another form of liquidity requirement.

Liquidity requirements “immobalize” assets within the banking system

Whether to meet Fed mandated reserve requirements or Basel III LCR requirements, when banks are required to keep liquid assets in the system to cover payment outflows, that money can actually NOT be used to cover payment outflows.

Because if that money was spent, for any reason, the liquidity requirement which it serves would no longer be met.

So increased liquidity requirements of necessity create demand for liquid assets, which, at least temporarily, drives demand for government bonds.

What is a “liquidity trap”, and how does it relate to all this?

It’s a different concept. The idea here is that if interest rates drop to zero, or near zero, the central bank can not lower interest rates further, and thus buying government bonds is no longer an effective tool to help central banks hit their target interest rate.

Is the recent repo activity “bailing out Wall St” again?

It’s not bailing out Wall St.

From a bigger picture, the relationship between the banking system and the central bank, where the central bank has to guarantee there are enough settlement balances in the system to meet liquidity requirements and to clear payments, shows the “franchise” nature of commercial banking.

There is a bigger picture

These liquidity requirements, these capital requirements, these attempts to regulate the banking system are trying to convince people that because we have these regulations that will prevent financial crisis, there is no future social cost to the banking system.

Here’s the story: There was a big social cost when the central bank had to bail out the banks in 2008, and the central bank is very sorry for that, but these new regulations “internalize the costs” so the banks and the banking system will cover these costs in the future.

But, this entire structure reveals how the central bank has “franchised” money creation to the commercial banking system.

The bigger picture issue is not that the central bank needs to bail out the banking system per se, but rather how within the banking system, there is a strong partnership between the government and the private sector.

The granting of a bank charter is the granting of privileges to a privately owned bank that most people believe is the exclusive domain of the government.

And it illustrates how banking IS effectively a government service being provided by private businesses.