We’ve all heard the best way to build long-term wealth is to buy and hold stocks.

Can governments do this for the benefit of their residents?

Yes, and some do. They’re called Sovereign Wealth Funds.

More of them exist than we realize.

Table of Contents

What exactly is a sovereign wealth fund?

A sovereign wealth fund is nothing more than an investment fund that is owned by a sovereign government. That’s it.

These sovereign wealth funds invest in assets such as stocks, bonds, real estate, private equity funds, and/or hedge funds.

In this regard, they are no different from other investment funds. The only difference is who owns the fund, and why.

Why are they created?

Sovereign wealth funds are generally created with a specific objective in mind, as you’ll see in some of the examples that follow.

Sometimes, people who are thinking into the future realize they can take advantage of the fact that, over the long term, the value of stocks and real estate tends to rise, and that they can use that to provide funding for specific purposes in the future.

Some funds cover specific aspects of government funding.

Alaska has a fund that pays an annual dividend to Alaska residents.

Texas has two funds, one of which helps pay for K12 education, the other of which help pay for the University of Texas and Texas A&M University systems.

The Norweigan fund now covers about 20% of annual Norwegian government spending.

Having said all that, many sovereign wealth funds in the world are fairly new, and to date, no withdrawals have ever been made.

Are they owned only by countries?

As you can see from some of the examples above, no.

In fact, the world’s first sovereign wealth fund was created by the government of the state of Texas.

The Texas Permanent School Fund was established in 1854 with $2M, and now has assets of $48B. As the name implies, the fund exists to provide funding for schools in the state of Texas.

The first sovereign wealth fund created by a nation was the Kuwait Investment Authority, which was created in 1953.

Can any government start such a fund?

I see no reason why not.

How are these sovereign wealth funds funded?

The general pattern is some government finds themselves with exports exceeding imports and being the government, and the one who sets the rules for the economy, they divert some of the money from the sale of oil, or some other resource, into a fund.

In other cases, the government found themselves in possession of some asset, such as land, and since the asset has to be owned by some legal entity, they created one for that purpose.

Can any government start one at any time?

Again, I don’t see why not.

I’m going to use this example of a private investor who, by virtue of being a private investor, does not create currency out of thin air.

Suppose you were such an investor, and you could borrow money at 2% (the current rate of the US 30 year treasury bond) and invest it in a fund that can conservatively expect to manage an investment portfolio that returns 6% per year.

That’s an easy 4% per year.

Should a national government do this?

Now let’s pretend you are a government that issues a currency. For sake of argument, let’s say the US dollar.

The government has two choices: “mint the coin” to create $1T without issuing treasury bonds, or create money the usual way and issue treasury bonds in the same amount.

Then use the money to fund an investment portfolio, that after only 2 years, starts to payout HALF of last year’s returns.

If the fund returned 5%, the fund would pay out 2.5%.

On a trillion-dollar fund, the return would be $50 billion, the payout would be $25 billion.

What would you spend the money on? Just send every taxpayer a check, of the same amount, like they do in Alaska.

The first year’s payment would be small, only $175 per taxpayer, but it would hugely shift perception about “the role of government” and the “value” of investing.

It’s common knowledge that many governments, and the US government, in particular, work to protect the interests of the investors.

By creating such a fund, you would immediately make every taxpayer an investor.

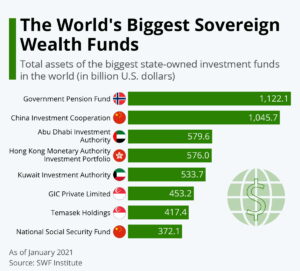

What are examples of sovereign wealth funds?

In the next post in the series, I examine some national sovereign wealth funds.

Who owns them, when they were founded, the assets under management, and what withdrawals are used for, for those funds for which there have been withdrawals.