We’ll start with the biggest ones.

Table of Contents

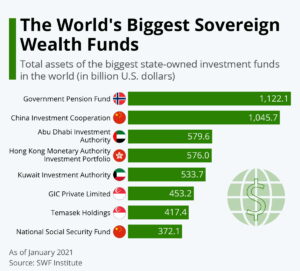

The Government Pension Fund of Norway

Total assets and year founded

The Government Pension Fund of Norway is actually two separate sovereign wealth funds owned by the government of Norway.

The Government Pension Fund Global has total assets of USD $1.3 trillion and was founded in 1996. It is the largest sovereign wealth fund on earth.

The Government Pension Fund Norway was founded in 1967 and is not one of the world’s largest, so it gets only a passing mention here.

How the fund describes itself

The first part of how they describe the fund is:

Norway’s oil fund, or the Government Pension Fund Global which is its official name, was created after we discovered oil in the North Sea. The fund was set up to shield the economy from ups and downs in oil revenue. It also serves as a financial reserve and as a long-term savings plan so that both current and future generations get to benefit from our oil wealth.

What are the proceeds used for?

Norway initially treated its fund like a rainy day fund.

Norway made its first withdrawal from the fund in Jan of 2016, twenty years after the fund was first established. The money was transferred to the Norweigan Treasury. I did not find any stated specific uses.

The Norweigan fund has averaged a 6.6 percent return from Jan of 1998 to Jun of 2021, and Norweigan law allows withdrawals of no more than 4% of the fund value per year.

So in theory, with those numbers, Norway is spending less than their annual appreciation.

Now, Norway withdraws money from the fund every year, and almost 20% of Norweigan government spending is funded by wealth fund withdrawals.

China Investment Corporation

Total assets and year founded

The China Investment Corporation is owned by the government of China, has total assets of USD $1.2 trillion, and was founded in 2007.

How the fund describes itself

The first part of how they describe the fund is:

Headquartered in Beijing, China Investment Corporation (CIC) was founded on 29 September 2007 as China’s sovereign wealth fund incorporated in accord with China’s Company Law, with registered capital of $200 billion. The company was established as a vehicle to diversify China’s foreign exchange holdings and seek maximum returns for its shareholder within acceptable risk tolerance.

What are the proceeds used for?

I have not been able to find evidence that China has EVER made a withdrawal from its wealth fund.

Kuwait Investment Corporation

Total assets and year founded

The Kuwait Investment Corporation is Kuwait’s largest sovereign wealth fund, total assets are USD $693 billion, and the fund was founded in 1953.

How the fund describes itself

The first part of how they describe the fund is:

As oil became an increasingly important source of revenue for Kuwait, our forefathers realized its potential to promote the sustainable development and welfare of the Kuwaiti people for generations to come. Among those was HH Sheikh Abdullah Al-Salem Al-Sabah (1950-1965) who in February 1953, established the Kuwait Investment Board (KIB) headquartered in the City of London with a mandate to invest surplus oil revenue and reduce Kuwait’s reliance on a single finite resource.

What are the proceeds used for?

I found several articles from Feb of 2021 reporting that the cabinet of Kuwait submitted draft legislation to the Kuwait parliament asking for permission to withdraw 5 billion dinars (USD $16.53 billion) from the fund every year.

In March of 2021, the Kuwait national assembly financial and economic affairs committee rejected the draft law.

Abu Dhabi Investment Authority

Total assets and year founded

The Abu Dhabi Investment Authority is owned by the Emirate of Abu Dhabi (in the United Arab Emirates), has total assets are $649 billion, and was founded in 1976.

How the fund describes itself

The first part of how they describe the fund is:

Established in 1976, ADIA is a globally-diversified investment institution that prudently invests funds on behalf of the Government of Abu Dhabi through a strategy focused on long‑term value creation.

What are the proceeds used for?

Since the Abu Dhabi Investment Authority does not publish withdrawal data, so there is no way to know.

Hong Kong Monetary Authority Investment Portfolio

Total assets and year founded

The Hong Kong Monetary Authority is the central bank of Hong Kong, and the name of the fund reflects the ownership of the Hong Kong government. Total assets are USD $586 billion, and the fund was founded in 1935, which seems pretty optimistic since back then Hong Kong was a very poor region.

How the fund describes itself

The Hong Kong Monetary Authority is the central bank of Hong Kong, and the name of the fund reflects their direct ownership

The first part of how they describe the fund is on the Investment Management page of the central bank website:

Guided by the investment objectives of the Exchange Fund, the HKMA regularly reviews the portfolio structure and target asset mix of the Exchange Fund, taking into account the risks the Exchange Fund can afford to take and the liquidity it requires, with a view to achieving long-term investment return. In addition, the HKMA actively manages the Exchange Fund’s assets. Most of the Exchange Fund’s assets are directly managed by the HKMA while the remaining assets are managed by external fund managers appointed by the HKMA.

What are the proceeds used for?

I was not able to find any information on fund withdrawals. I’m not sure if there have never been any, or if they’re not reported.

Are there equivalent American and Canadian funds?

This is the topic for the next post in the series.