This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth.

If you found this post via search, it probably makes sense to start with the link to the full series, which is both here, and above.

Can Independent Fiscal Councils help alleviate Angrynomics?

To me, this next idea is brilliant in its simplicity.

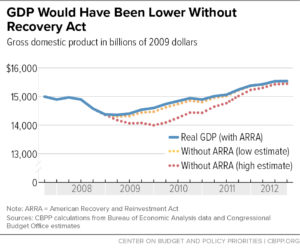

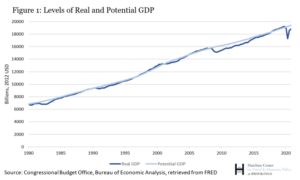

I don’t think anyone still exits who will argue that central bank fiscal stimulus during recessions does not help stimulate economies and does not help keep recessions from becoming even worse. At least no one anyone else would take seriously.

The important questions no longer have to do with “will we do we do something”? But rather have to do with “WHAT will we do”?

So the idea is to figure out what fiscal stimulus will be used as part of the response to the next recession and to do so in advance of that recession happening.

The authors credit this idea to the American economist Claudia Sahm, who is a senior fellow at the Jain Family Institute, which describes itself as “a nonpartisan applied research organization in the social sciences”.

Having said that I googled for various combinations of “Claudia Sahm” and “Fiscal Councils” and while I found various writings of hers about fiscal stimulus, I found nothing on Independent Fiscal Councils.

Don’t they already exist?

It seems the answer is “sort of”, in as much as the International Monetary Fund identified 39 such councils that existed prior to 2016, from which I learned that some existed in the USA and Canada since before the 2008 financial crisis.

However…

It turns out the US Congressional Budget Office is considered to be one, which surprised me, as all I’ve ever heard of them in the past is that they score bills in congress for how those bills might affect the federal deficit, which of course is not the right thing to score for in an economy where the federal (currency issuer) deficits are where private sector surplusses come from.

In Canada, the Parliamentary Budget Office is also considered to be one, and they seem to serve a similar function to the American CBO.

Are the authors proposing something different?

It seems the answer is yes.

The idea being proposed in the book is that fiscal councils be set up in which future fiscal stimulus will be predefined in advance of the next recession, as will the triggers for activating these fiscal policies.

That way, when the next crisis hits, we don’t need to wait for politicians to gather, argue over whose donors deserve more cash, and allow the political “whims of fortune” to dictate what fiscal stimulus, if any, will occur.

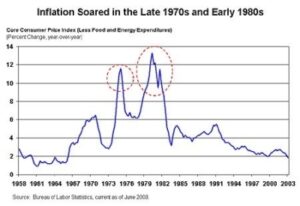

I think the criticisms that the 2008 fiscal stimulus and the post-Covid fiscal stimulus favoured big business and big banks over smaller firms and households is valid.

They not only clearly did, but they also added fuel to the fire of extreme corporate consolation in the American economy.

The second biggest problem in the US economy today is the degree to which corporate consolidation is congregating wealth in the hands of fewer and fewer people.

Of course, the biggest problem is the crony capitalism campaign finance laws which make that pretty much inevitable.

So the idea that we create fiscal stimulus rules in advance when the economy does not have a metaphorical gun to its head, has A LOT of appeal, at least for me.

I see it as being the most neutral method of defining fiscal stimulus rules to help support the economy through the next recession.

And for that reason, I hope this idea becomes a reality.