The quantity theory of money inflation is the idea that inflation is a simple phenomenon that is caused by adding money to an economy.

It is represented by that fairly famous equation shown in the image at the top of this post.

I’ll explain what that equation says, how it is used to derive the belief that inflation is a function of adding more money to an economy, and how we know that, at best, it’s a very incomplete story, and at worse, it’s just not true.

If you found this blog post via search, it probably makes sense to start at the first post in this series, as it contains information and ideas that are mentioned here.

Table of Contents

First, two things that are equal to the same thing

As Daniel Day Lewis so eloquently said, in that movie in which he played Abraham Lincoln…

Euclid’s first common notion is this…. Things which are equal to the same thing are equal to each other.

This post contains some math

And I apologize in advance for that, but this math is necessary to explain this idea. It’s pretty simple.

Two different ways to express GDP

M represents the total amount of money in an economy.

V represents the “velocity” of money, which is how many times each dollar changes hands in a year.

GDP = All the money in an economy, multiplied by, the number of times each dollar changes hands.

GDP = M x V

GDP = MV

This is not a controversial statement. This is a valid way to express GDP.

Additionally…

P represents the price level in the economy, or, what things cost.

T represents the number of transactions.

GDP = The cost of things, multiplied by, the number of times things were bought.

GDP = P x T

PGD = PT

This is also not a controversial statement. This too is a valid way to express GDP.

And that means

If GDP = MV, and GDP = PT, it then follows, that…

MV = PT

A few simple algebraic substitutions

Let’s solve for P.

If MV = PT, then…

PT = MV

When we divide both sides by T, we get…

P = (MV) ÷ T

Which shows

That when V and T remain the same, any time M increases, P increases.

THIS is the origin of the idea of the quantity of money inflation idea.

How do we know it’s wrong?

Or at least an incomplete explanation.

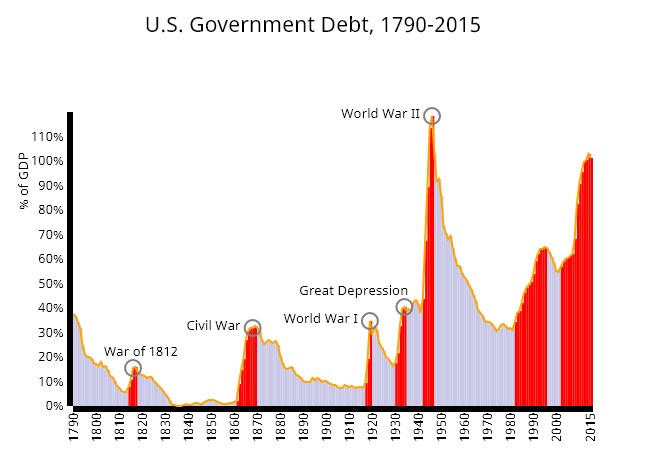

Keep the chart below in mind as you read further. It shows the US government debt as a percentage of GDP.

1929

In the roaring twenties, the stock market surged.

Everybody wanted in on it.

It was common to buy stocks “on margin” which means the stock brokerage firm loaned the investor (or speculator) money with which to buy the stock.

From the perspective of the investor or speculator, it was debt.

While doing so amplifies the effects of gains, it also amplifies the effects of losses.

In 1929, margins were 10%, which means if you wanted to buy $1000 worth of stock, you only need to deposit $100 with the broker, and the broker would loan you $900.

If the stock rose in value, you sold it, paid back the broker, and made a tidy profit.

If the stock fell in value, you needed to add money to your account to maintain your margin requirement.

If you did not, the broker was allowed to sell your stock, keep the proceeds, and collect whatever else you owed from you.

If you’re interested in the details of how buying stocks on margin works, read this: Margin call: What it is and how to avoid one.

The long and the short of it after the stock market crashed in 1929, millions of people had debt from having bought stocks on margin, that they could not pay.

It ground the economy to a halt.

Investment and consumer spending dropped to near zero.

So, the federal government injected (what was at that time) massive amounts of money into the economy in an effort to boost investor confidence and get consumer spending going.

No inflation.

2008

This was another debt-fueled bubble, but a different form of debt.

Leading up to 2008, Wall St firms had decided there was money to be made taking mortgages, compiling them in batches, and selling shares on those batches.

These were known as Mortgage-Backed Securities.

Investors loved them.

Eventually, the Wall St firms ran out of good quality mortgages made to people with steady incomes who could be expected to make their payments.

So they started selling Mortgage-Backed Securities made up of mortgages given to people who didn’t have steady incomes and could not be expected to make their payments.

Some Wall St firms later decided there was even more money to be made selling an insurance-like product called Credit Default Swaps, which would payout in the event the mortgage payments for whatever reason stopped flowing in.

Credit Default Swaps were seen as a risk-free way to make money, as a default would require mortgage defaults on an unprecedented scale, and such an event was considered unimaginable.

As they weren’t really insurance, they weren’t regulated as insurance, so no one checked to see if the firms selling them could make the payouts in the event they had to.

The unprecedented level of mortgage defaults that was considered unimaginable started early in 2008.

Firms who sold Credit Default Swaps were called upon to pay out, and couldn’t.

This came to a head in September of 2008 when Lehman Brothers failed.

It ground the economy to a halt.

Investment and consumer spending dropped to near zero.

So, the federal government injected massive amounts of money into the economy in an effort to boost investor confidence and get consumer spending going.

No inflation.

Which tell us

That when the US government injected massive amounts of money into the economy, the things that were expected to “stay the same”, didn’t stay the same.

Economies are complex and have LOTS of variables.

If V and T from the above equation had stayed the same, there would have been inflation.

But there wasn’t, so clearly they didn’t.

WW2

Because somebody SHOULD call me on this, during WW2 the US economy did experience inflation.

It was also a period of massive growth in the money supply.

Having said that, the US economy was experiencing massive shortages of pretty much everything, as almost everything was diverted to the war effort.

Shortages is one of the theories that will be covered in a different post in this series, but the situations from 1929 and 2008 do show us pretty definitively that adding money to the economy, does not, in and of itself, cause inflation.