Table of Contents

A little background information on this US treasury auctions explainer video

This is a goofy little video published to YouTube six years ago that does a very good job of explaining how US treasury auctions work.

It’s in a question and answer format, where the grandson is asking questions of his grandmother who is an economist who used to work at the US treasury.

The transcript below is not word for word in that I omitted the parts that were not part of the Q&A, such as when the characters are being introduced or doing a little grandma grandson banter.

This is a summary, not a word-for-word transcript.

The grandson’s questions are in bold, the grandmother’s answers are below them.

Did you know the federal government is going to run a 506 bazillion dollar deficit this year?

Bazillion isn’t a real number. I think you mean 506 billion dollars. That’s the Congressional Budget Offices projection for this year.

How can the federal government can just force-feed US treasuries onto private American citizens to finance their pork belly spending habits?

That isn’t quite the case.

US treasuries are interest-bearing, virtually no-risk financial assets for private citizens.

They are quite a good investment. They fulfill quite an important role in our econonmy.

The US government doesn’t force-feed US treasuries to anyone.

Since they are such a good asset, a lot of people want to purchase them.

Really? Who wants to buy treasuries?

Well, for example, pensions and mutual funds own many US treasuries.

Speaking of which, back in my day, at the treasury, we perfected the system to sell US treasuries by auction.

What do you mean? Treasury sells these securities by auction?

The treasury has been using auctions since 1929 and the system has evolved a lot in the intervening years.

Why?

Our understanding of how auctions work has improved since then.

The key thing to keep in mind is the treasuries auction off many securities at any given time.

This is called a multilateral auction.

Let’s talk about two features of how these auctions work, non-competitive vs competitive bids and a single price system.

Non competitive bids? What’s that?

Anyone can participate in Treasury auctions, even you and I.

There are two types of bids, non-competitive bids, and competitive bids.

Individuals and smaller institutions submit non-competitive bids.

Non-competitive bidders are guaranteed to win the auction.

They leave the auction with the amount they requested.

If all non-competitive bidders get the amountof treasuries they request, why don’t all bidders submit non-competitive bids?

Non-competitive bids are limited to $5 million of treasuries.

Most large institutions submit competitive bids because they want more than $5 million worth.

Competitive bids include the bidder’s lowest acceptable interest rate.

That is the interest rate the government pays the holder of the treasury.

The other important feature is the single price system.

All treasuries have the same interest rate which is determined by the auction from its lowest accepted competitive bid.

In the past, when a bidder won their auction, they were paid the interest rate that they specified on their bid.

Can we do an example with actual numbers?

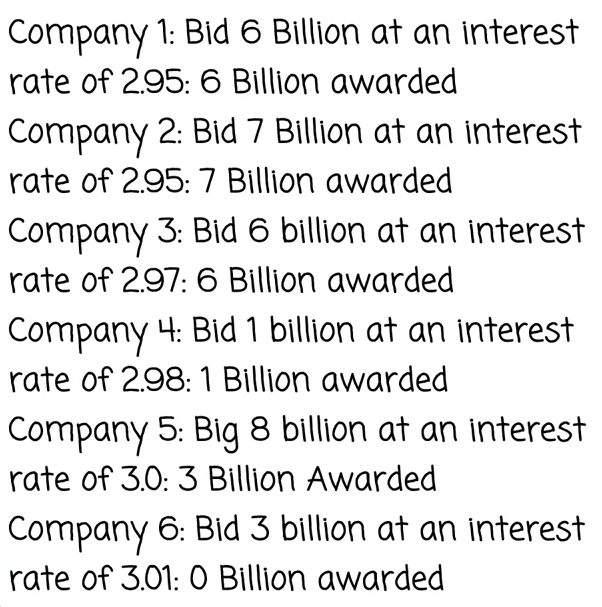

Let’s say that the treasury is auctioning off 24 billion in securities.

First, we look at non-competitive bids.

Say lots of non-competitive bidders participated in this auction, and if you add all their bids up, the total amount of non-competitive bids is one billion dollars.

We know that all the bidders get what they asked for, so there is 23 billion dollars worth of treasuries leftover for competitive bids.

In the competitive auction, each bid includes the lowest interest rate the bidder is willing to receive.

Each bid also includes the amount of treasuries they want.

For example, company 1 who stated the lowest interest rate and the lowest amount gets their bid accepted, then company 2 gets their bid accepted.

After they accept companies 1 and 2’s bids, the government has 10 billion dollars remaining.

Now company 3 gets their bid accepted at an interest rate of 2.97.

This continues until we reach company number 5.

Since company number 5 wanted 8 billion, but there is only 3 billion worth of securities remaining, they only get awarded 3 billion.

However, since company 5 is the last company, the interest rate they requested becomes the standard interest rate for all treasuries.

So company 1 obtains a 3.0% interest rate.

And we can’t forget about our non-competitive bidders.

They are also affected by the results of the competitive bidding.

So everyone who bought treasuries received the same interest rate as company 5, which is 3.0%.

What happens if no one wants to buy treasuries?

Like I mentioned, US treasuries are a no-risk interest-bearing investment.

There is no safer financial asset to have on your balance sheet.

It’s hard to think of a time when no one will want to buy them.

What if?

Do you know what the Fed is?

I’ve heard of the Fed, but I don’t really know what it does

The Federal Reserve, or the Fed, is the central bank of the United States.

They target interest rates and are in charge of supplying most of the US currency.

They print the dollar bills in your piggy bank.

To control interest rates, the federal reserve manages the amount of reserves held by the banks.

They do this by buying and selling assets.

What do they have to do with treasury auctions?

After a specified amount of time, all treasuries mature.

When a given treasury matures, the holder gets the principal and the accrued interest payment.

They come with many different maturities.

From 1 month and 3 months to 20 years and 30 years.

The Fed’s most common assets are US treasuries.

Treasuries held by the Fed are maturing every day.

The Fed needs to constantly buy new treasuries.

Thus the Fed is a stable source of demand in treasury auctions.

The treasury also uses what’s called the primary dealer system.

What is the primary dealer system?

The primary dealers are large financial institutions that deal directly with the federal reserve bank.

To be a primary dealer, these institutions are legally bound to submit reasonable bids in every treasury auction.

This way, no matter what happens, bids are always placed in the auctions.

What if the primary dealers don’t have enough money to buy a bunch of treasuries?

These banks deal directly with the federal reserve bank.

In the event a primary dealer doesn’t have enough money in reserves to make a reasonable bid, the Fed will buy some of the older treasuries on the bank’s books.

This means the primary dealer has more reserves and fewer treasuries.

Then at the auction, the primary dealers bid for new treasuries to replace the ones the Fed bought from them.

So even if the primary dealers don’t have enough moneyon hand to place a reasonble bid, the Fed makes sure that they do when the auction comes around?

Exactly!

So does the primary dealer system also help make sure the Fed has enough treasuries on their balance sheet?

Correct.

In the past Congress had limited the ability of the Fed from buying treasuries directly from the treasury.

The relationship between the treasury and the Fed gets a little complicated.

Basically, the primary dealers act as an important middle man between them.

Credits

Wray, L (2012). Modern money theory: A primer on macroeconomics for sovereign monetary systems. New York: Palgrave Macmillan.

Garbade, K. & Ingber, J. (n.d.). The Treasury Auction Process: Objectives, Structures, and Recent Adaptations. Retrieved April 14, 2015.