If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full series is above.

In this series of posts, I examine seven nations whose economic vitality transformed them from poor countries into rich countries.

The focus of this post is the rebuilding of Japan after WW2.

Table of Contents

A ruined state

Everyone knows Japan was badly damaged by WW2. Here are some specifics.

- About 2 million dead (about 4% of the population)

- About 680,000 injured or missing

- One quarter of national material wealth destroyed

- 90% drop in industrial capacity

- Commodity shortages leading to hyperinflation

Yet by 1990, in a period of only 45 years, Japan transformed into the world’s second-largest economy.

Immediate post war government

A few days before the surrender of Japan in September of 1945, Douglass MacArthur was appointed to be the Supreme Command for the Allied Powers, he was in effect Japan’s American viceroy.

He had the final decision in all matters relating to the governing of Japan.

Unlike Germany, after WW2, Japan had a functioning government, and MacArthur and his people ruled Japan through them.

This phase lasted until the new Japanese constitution went into effect in May of 1947.

The US occupation of Japan ended in 1951.

Immediate post war policies

As the war ended, a few Japanese men organized a study group to think through the post-war recovery.

The first meeting was in Aug of 1945, and while it started as an informal effort, it later became the Special Survey Committee of the Ministry of Foreign Affairs.

A first draft report was produced in Mar of 1946, and the final draft was produced in Sep of 1946.

The report, titled “The Basic Problems of Japan’s Economic Reconstruction” was 193 pages and was considered very comprehensive.

Priority production systems

This was essentially a name for industrial rationing.

Resources were diverted to a few key industries deemed best to kick start the economic recovery and likely to “spill over” into other industries.

Labour laws

This was back when the US was big on labour unions, worker rights, collective bargaining, etc. The US forced Japan to adopt what at the time was considered necessary protections for labour.

Land reforms

Bye by absentee landlords. The farmland of absentee landlords was confiscated and sold to the actual tillers, which greatly increased land ownership. This focus on small-scale family farming in Japan continues to this day.

Breaking up business conglomerates (zaibatus)

Big businesses accused of helping the military buildup during the war were broken up into smaller entities.

It was later replaced with the concept of the “supply chain collective” called Keiretsu, which is described below.

The new constitution

A new constitution was essentially forced upon Japan, which had some say in some of the details but was not the dominant party involved in its drafting.

One article is especially controversial, article 9:

Aspiring sincerely to an international peace based on justice and order, the Japanese people forever renounce war as a sovereign right of the nation and the threat or use of force as means of settling international disputes.

In order to accomplish the aim of the preceding paragraph, land, sea, and air forces, as well as other war potential, will never be maintained. The right of belligerency of the state will not be recognized.

Japan did create a “self-defense force” in 1954, but they had zero operations outside of Japan until 1992 when non-combat units started participating in United Nations peacekeeping efforts.

In 2004 the United States requested Japan deploy troops to Iraq to help with the reconstruction, and Japan sent 5,500 troops who left in 2008.

Economic assistance as part of the fight against communism

American economic assistance became part of the anti-communist strategy after WW2. Rebuilding Japan was just one more front in the cold war.

Total US assistance to Japan from 1946 to 1952 was roughly $15.2 billion in 2005 dollars, of which 77% were grants (which do not need to be paid back) and 23% of which were loans.

The end of American occupation

The US occupation of Japan ended after the signing of The Treaty of Peace with Japan in September of 1951.

From that point on, Japan itself was in charge of its economic development, and everything else.

Keiretsu

Keiretsu refers to cooperation between manufacturers, suppliers, distributions, and banks in close-knit groups. While it’s not a uniquely Japanese concept, that they have a word for it shows this idea was important within the culture.

It started in the early 1950s and continues to this day.

In fact, it foreshadowed the modern phenomenon of supply chain vs supply chain competition superseding firm vs firm competition.

There is an aspect of this related to banking I find very interesting, which I describe below in the section about the banking system.

Foreign investment

During American occupation

I found no evidence that foreign investment in Japan during the years of American occupation exceeded the $15.2 billion mentioned earlier.

After American occupation ended

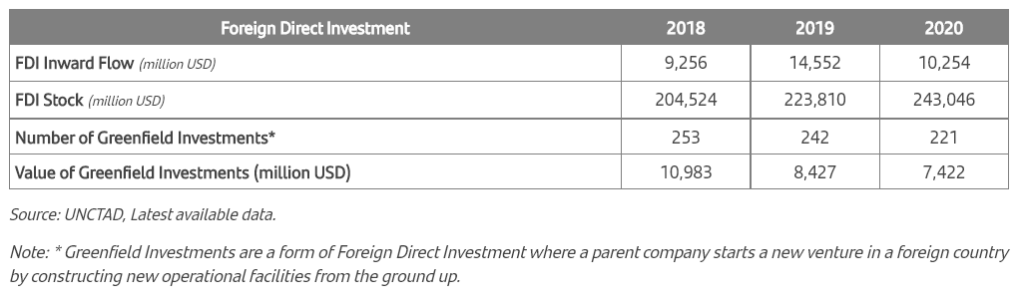

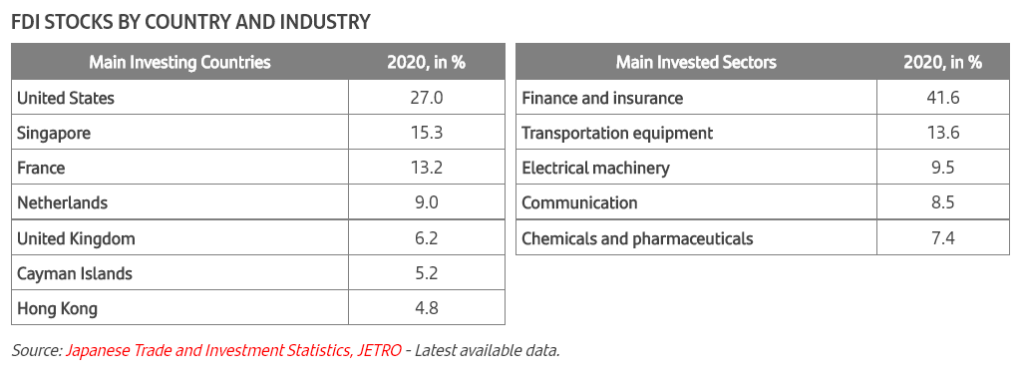

However, foreign direct investment in Japan is now on par with the four Asian tigers.

The Korean War

The Korean war gave a boost to Japan’s economy as Japan became a supplier of goods the US needed for the war. During the war, the US government bought 27% of Japan’s exports.

Domestic social investments

After WW2, the focus of Japanese domestic investment seemed focused entirely on growing productivity and exports. I find no mentions of social security and social insurance until the 1960s, a full 15 to 20 years after the war ended.

Today, Japan, relative to other industrial nations, has a fairly standard system of social security consisting of old-age pensions and universal healthcare.

Interestingly, the webpage about social security from the Ministry of Foreign Affairs of Japan, states that personal social services for the elderly and the disabled, as well as family policies to support working women, are “relatively backward fields in social security”.

They also describe family policy to support working women with children as “underdeveloped”.

The legal system

Of course, things changed drastically in Japan on the 3rd of May in 1947, when the new Japanese constitution went into effect.

The current legal system is a hybrid of civil law system similar to what is found in Germany and France, American influences that come from American pretty much force-feeding Japan a new constitution after the war, and traditional Japanese values.

There are five types of courts: the Supreme Court, High Courts, District Courts, Family Courts, and Summary Courts.

The system has three tiers. Every case starts in a summary court, a family court, or a district court.

Appealed cases are heard by a high court, and in some cases by the Supreme Court.

The banking system

The central bank of Japan is The Bank of Japan, which issues its sovereign currency, the yen.

There are some interesting aspects of the Japanese banking system that while probably not particularly Japanese, seem to make a lot of sense.

Separating banks by function

One thing I find particularly interesting is the degree to which the Japanese Ministry of Finance separated banks by function.

“Each segment of the banking industry serves a distinct segment of the market. With certain exceptions, players in one sector are not permitted to engage in business in any other sector” (Milhaupt and Miller 2000:248). Unlike the Anglo-American banking system, the Japanese banking system is systematically segmented into commercial banking and long-term credit banking. Also the Japanese commercial banks were separated into “city” and “regional” banks according to their branch networks. Most of their business was short and long term lending to Japanese corporations. City banks were by far the most powerful financial institutions in Japan. Regional banks, on the other hand, have strong ties with small and medium firms in their local area as well as with local government (Lapavitsas 1996:24).

The Bank-Based Financial System and Kinyu Keiretsu, page 47

To me, the names City Bank and Regional Bank seem backward, as regional banks provide loans within limited geography (which is what I find so interesting) while city banks are the megabanks we in the USA all know and hate.

The regional banks are a type of bank in Japan that due to banking regulations are somewhat forced, or at least encouraged, to get to know the people they make loans to, by virtue of making loans within a limited geography.

It seems this would dampen the enthusiasm for knowingly making bad loans, which was so rampant in the lead up to the 2008 financial crisis in the United States.

The Bank of Japan rescue of the ruined economy

This next thing is something I learned first from economist Richard Werner, who later coined the phrase “quantitative easing” when referring to central banks buying bad debt from banks and other companies as part of responding to the 2008 financial crisis.

I do not recall him saying quantitative easing is based on what the Bank of Japan did after WW2, but they’re virtually identical, so I can’t help but wonder.

Although I did not watch this entire documentation immediately prior to writing this post in order to get a timestamp, the story I tell below is somewhere within this documentary, which is based on his book titled The Princes of the Yen.

After WW2, almost every bank and every business in Japan was insolvent.

They had balance sheets that contained liabilities, and to a creditor, the loans they make are assets to them, because they’re going to receive money every month.

Except for the loans that can’t be repaid.

But what happens when almost ALL of the assets become worthless, because, you know, WW2?

Almost every bank and every business in Japan was insolvent and had zero chance of getting money with which to pay their creditors.

So, what’s a central bank to do?

How about buying those bad loans at face value, and moving those worthless assets from the balance sheets of the insolvent banks, manufacturing companies, etc onto the balance sheet of the central bank where they can sit and rot.

And, in exchange for those bad assets, giving the banks and firms money.

As if the central bank had purchased loans they intended to collect on, even though everyone know that was never going to happen.

This IMMEDIATELY cleared the bad debt from the balance sheets of the firms and gave them cash with which to make their payment obligations.

How can a central bank do such a thing? Because they’re where currency comes from.

They just created the money and used it to buy the bad debt.

This is in fact what Quantitative Easing is, but as that phrase was coined after 2008, the Bank of Japan must have called it something else.

Anyway, while it was a bit of “out of the box” thinking, it worked.

In closing

It seems the economic rebuilding of Japan after WW2 was a somewhat complex combination of draconian martial law during the early part of the American occupation period, exhaustive economic planning, a complete overhaul of the constitution and legal system, some truly out of the box thinking by the Bank of Japan, and very strict financial stewardship by the Bank of Japan and the Japanese Treasury, who, while not delved into in this blog post, did not always get along, which you can learn more about if you watch the documentary above.