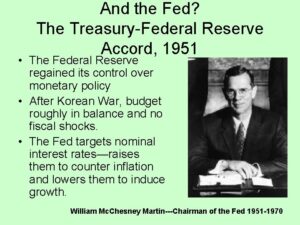

The Fed-Treasury Accord of 1951 was a bank regulation that created what we refer to as the independence of the Fed. We say this because compared to what was before, it made the Fed independent of the Treasury.

Table of Contents

A little background

Working under the belief that currency-issuing governments actually borrow the currency they issue, the Treasury “borrowed” US dollars from the Fed (for now let’s ignore the fact that the independence of the Fed is what Congress says and that all Fed profits are deposited into an account used by the Treasury), the Treasury wanted a low-interest rate, as the Fed interest rate was something the Treasury paid, and they wanted that number to be as low as possible.

————————————

This post is part of a larger series and sub-series.

Here is a link to the series: The history of banks and banking regulation

and to the sub-series: United States Banking and Bank Regulation History

————————————

As Treasury bonds also influence the amount of reserves in the banking system, when the Treasury buys and sells bonds they affect the availablity of credit through commercial banks.

The 1951 Fed-Treasury Accord separated the Treasury borrowing from the Fed, from the Fed’s mandate to manage the availability of private credit in the commercial banking system.

This was done by releasing the Fed from its mandate to keep Treasury security interest rates low.

Renewed focus on price stability

The Fed now had one primary mandate. Managing the level of reserves in the banking system for purposes of managing the level of private credit available, which in turn was for purposes of keeping inflation low and growth high. This was done by managing the interest rate on Treasury securities, then either selling them to member banks (to reduce reserves) or buying them from member banks (to increase reserves).

This is a purely monetarist view of what causes inflation, but not only was that a dominant thought at that time, it still is.

So, the thinking goes, the level of banking reserves is the fulcrum from which the Fed manages the level of inflation.

When inflation is too high, banking reserves are reduced by selling Treasury securities to member banks, and when inflation is low and the desire is to stimulate growth, banking reserves are increased by buying Treasury securities from member banks.

When the Fed buys Treasury bonds from member banks, they increase demand which raises prices (interest rates) and when the Fed sells Treasury bonds to member banks they increase supply which lowers interest rates.

Banking reserves and monetary policy vs fiscal policy

This managing the availability of private credit through managing the level of bank reserves was, and is, called monetary policy, which is in contrast to fiscal policy, which is where the Treasury expands or contracts the monetary base, which is the total currency (money and currency are different) in the economy.

In this vernacular, currency is Treasury issued US dollars, much of which exists as banking reserves. Money on the other hand includes bank loans made by private banks based on the banking reserves.

I’m going to reflect a moment on monetary vs fiscal policy, as while they are different, the goal of each is similar, to influence how much money is in the econonmy. They however do that in very different ways.

Fiscal policy

Fiscal policy is implemented by the Treasury and involves expanding and contracting the monetary base through government spending and taxation. Spending injects dollars into the economy and taxes take them out.

Some of this monetary base exists in the form of banking reserves, which influence the level of private credit availability in the economy.

Fiscal policy directly affects the monetary base, and indirectly affects the level of banking reserves.

Monetary policy

Monetary policy is implemented by the Federal Reserve and involves expanding and contracting the level of reserves in the banking system through the buying and selling of Treasury securities with the primary dealers, who are member banks of the Fed.

Monetary policy directly affects the level of banking reserves.

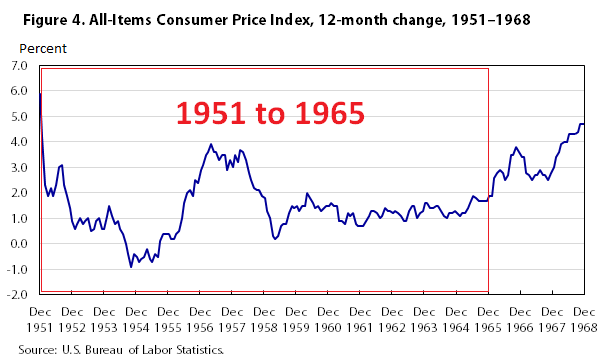

And… It worked, for 14 years

As you can see in the chart below, from 1951 to 1965, inflation stayed low. Partly as a result of the Fed managing the level of private credit available in the economy by managing the level of reserves in the commercial banking system.