Table of Contents

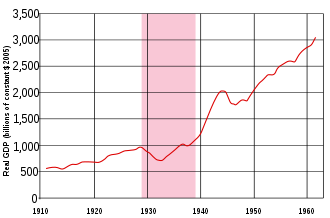

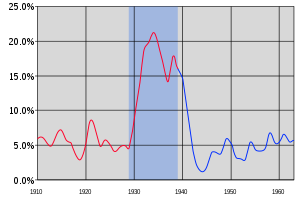

How big was the problem?

The economic impact of the great depression is illustrated by the two charts below. The first shows the US GDP with the depression time period shadowed in pink and the second shows the US unemployment rate with the depression time period shadowed in blue. These graphs illustrate why the new deal was considered both important and urgent.

————————————

This post is part of a larger series and sub-series.

Here is a link to the series: The history of banks and banking regulation

and to the sub-series: United States Banking and Bank Regulation History

————————————

How did it happen?

Two things became apparent fairly quickly:

#1) Buying stocks on margin (with debt) had gotten out of hand, creating massive amounts of debt that would not be repaid in the event the stock market valuations took a dive, which did, in fact, occur in Oct of 1929, which ground the financial system to a halt and triggered an enormous number of insolvencies and bankruptcies. By 1932, one-quarter of the banks in the United States had failed.

#2) Financial institutions speculated with customer deposits.

Can it be prevented from happening again?

As a result of the above, the federal government made some significant changes.

In aggregate, these changes are referred to as The New Deal, and it consisted of three broad components:

- Relief for unemployed people and poor people

- Recovery of the economy

- Reform of the financial system

This post summarizes the reforms of the financial system.

The new deal was implemented in two parts, the first new deal was implemented in 1933 and 1934. The second new deal was implemented in 1935 and 1936.

The first new deal: 1933 to 1934

With a focus on banking regulation, the first new deal included the Emergency Banking Act and the 1933 Banking Act, which created federal deposit insurance and the Federal Deposit Insurance Corporate which administers it.

1933: Emergency Banking Act

This act was started during the prior Hoover administration, introduced to Congress on March 9th, 1933 (5 days after the first inauguration of Franklin Roosevelt), passed by both houses of Congress later that same day, and signed into law by President Roosevelt also later that same day. The speed with which this bill became a law demonstrates how important it was considered to be.

This act strengthened federal oversight of banks and the banking system. It provided for the comptroller of the currency to restrict operations of banks with inadequate assets, allowed the secretary of the treasury to buy stock on behalf of the government in a bank needing additional funds, and gave the federal reserve the flexibility to issue emergency currency, backed by assets of a commercial bank.

1933: Banking Act (Glass-Steagall)

This bill was signed into law on June 16th, 1933 and was a pretty comprehensive overhaul of the nation’s banking laws.

It created the Federal Deposit Insurance Corporation which administers federal deposit insurance on behalf of the US banking system and separated investment banking and commercial (retail) banking. Commercial banks were prohibited from dealing in securities, and investment banks were prohibited from having close connections to commercial banks, such as overlapping directorships and common ownership.

After this became law, institutions had one year to decide which type of bank they wanted to be and to become it.

Commercial banks were henceforth allowed to derive no more than 10% of their income from securities, with the only exception being that they could underwrite government bonds.

Another significant rule change is Regulation Q, which first came into existence in this act, and at that time prohibited commercial banks from paying interest on checking accounts. The idea was that by limiting what banks paid in interest to attract new deposits, they would limit the need for creative (i.e.: risky and/or of questionable legality) ways to generate revenue in order to cover the required interest fees.

This ushered in the era of 3-6-3 banking, which means paying 3% interest on savings, charging 6% interest on loans, and playing golf every afternoon at 3 pm. Because after Glass-Steagall, commercial banking got boring, and stay that way for a few decades.

The act also strengthened federal reserve oversight of the US banking system and created the Federal Open Market Committee (FOMC), the people we hear about today who set the target interest rate. This was legislatively accomplished by amending the Federal Reserve Act.

The act also prohibited federal reserve member banks from making loans to any officers of the bank.

The second new deal: 1935 to 1936

Again, with a focus on banking regulation, the second new deal included the Social Security Act, which while not strictly a banking regulation, was a piece of significant financial legislation as it effectively turned the US federal government into a retirement savings account by taxing now and paying benefits later.

The Social Security Act was signed into law on August 14, 1935, and set up the old-age pension system within the United States, financed by a payroll tax on both employers and employees.